Hi,

I have added VAT Validation and tested it with a real payment (Stripe), it worked well. The issue is when I tried to fill in a fake VAT number, it showed that VAT is included but when I pay, no VAT is included.

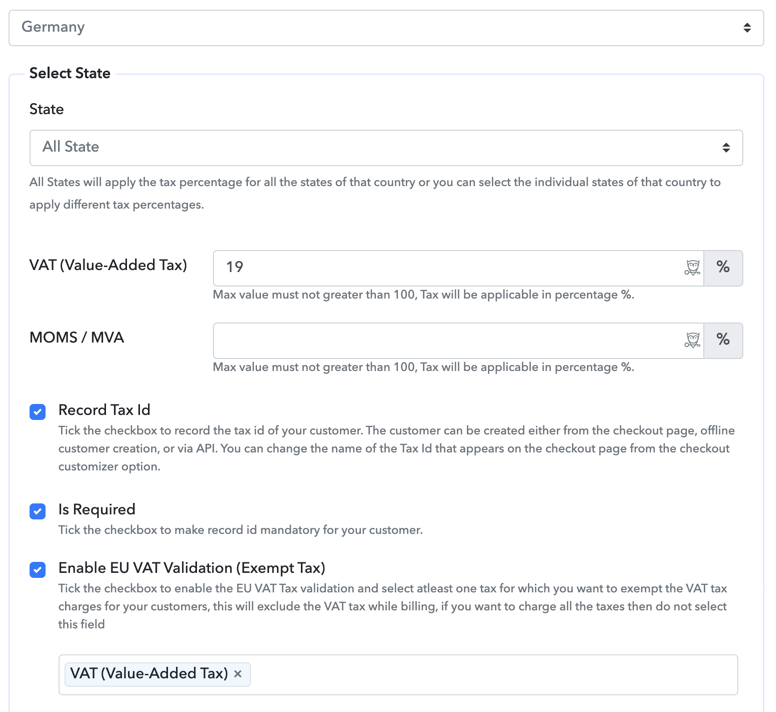

Example - Germay: 19% VAT. My VAT set up is as below.

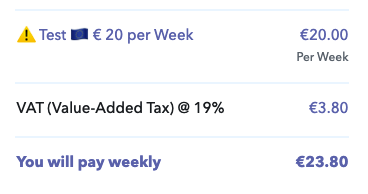

My product is €20. When I proceeded a test payment with a fake VAT ID ( I used ABC123456 ), it shows that 19% VAT is to be included - see below.

After I clicked Next, Stripe was chargning me €20 and not €23.80 - No VAT was charged. Then when I checked in Invoices in Pabbly, it showed that the charge was €20, no VAT included.

My questions:

1. How do I charge VAT when a wrong / fake VAT ID is used?

2. When a customer pays, how do I know that their VAT ID is validated and correct?

I have added VAT Validation and tested it with a real payment (Stripe), it worked well. The issue is when I tried to fill in a fake VAT number, it showed that VAT is included but when I pay, no VAT is included.

Example - Germay: 19% VAT. My VAT set up is as below.

My product is €20. When I proceeded a test payment with a fake VAT ID ( I used ABC123456 ), it shows that 19% VAT is to be included - see below.

After I clicked Next, Stripe was chargning me €20 and not €23.80 - No VAT was charged. Then when I checked in Invoices in Pabbly, it showed that the charge was €20, no VAT included.

My questions:

1. How do I charge VAT when a wrong / fake VAT ID is used?

2. When a customer pays, how do I know that their VAT ID is validated and correct?